Has anyone considered the lack of media coverage for the

first congressional district race? While

I haven’t scoured each web page of every news site, from what I have seen, the

coverage of where I lived for 12 years has been abysmal, especially considering

the significance. This is the 1st time in more than a GENERATION that we have

an incumbent-free election that is more open than ever. The choice made could

be another Alexandria Ocasio Cortez (who regular gains national attention), or

we could have just another of the 400 relatively obscure members, and receive

very little for the votes.

And why should we care about a PRIMARY? Well, in Chicago, Only TWO local candidates

have ever won in the general election in Chicago in the past 40 years. One of

them was state senator James Meeks, who

ran at the height of Salem Baptist church's popularity. Once he was elected, he

quickly switched he switched to the Democratic Party so that his re election

was assured the next term .

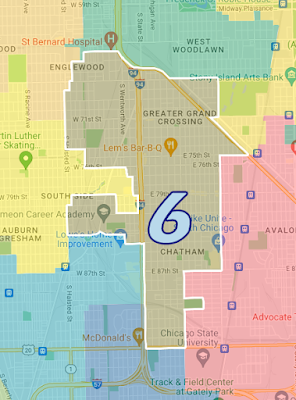

The 1st congressional district election is very meaningful

to me because I lived in Chatham for 12 years. I have seen which of the

candidates had been involved in the community and which have suddenly made and

appearance when Bobby Rush. decided to retire to retire.

I'm angry that we have had a lack of coverage, but

also the journalists that do report seem to have a complete lack of knowledge

of who is actually a community leader in the 1st district as opposed to those

who are being promoted due to their association with more famous people and/or funds. For example, Jonathan Jackson

is the son of Jesse Jackson, but in my 12 years in Chatham I have never seen or

heard him at any community event. That

is a stark difference to Jahmal Cole who has written a book about the community,

and in my time there has risen from being a mere resident to a community

influencer that has tried his best to help improve the community through his

nonprofit activities (and accolades) that have stretched far beyond even the

immediate community.

Journalists have also completely failed to use basic

math to show just the uniqueness of this election. For example, if all 17 Democratic

candidates who are currently on the ballot were to almost equally get a

percentage the winner of that election, then the final candidate would win by

only with only 7% of the votes. That would mean over 90% of residents would not

be able not be able to get their choice AT ALL. (Unlike the mayoral race, which

featured a runoff, so that the 83% of people who did NOT vote for Lori

Lightfoot at first, at least had an opportunity to choose from the top 2). And if you were to be a little more realistic

and just only assume that say, the top 4 candidates would get the majority of

the votes , that would mean that the top candidate could win with only 26% of

the vote. That would mean again over 70% of the voters would not have their

choice in office at all .For this election (as opposed to mayoral or aldermanic

races) we have no such opportunity for the majority to have their say.

I have not heard one reporter do the traditional

journalistic work of actually going out and talking with real people about what

they are thinking. It is not a difficult

task nor would it take a lot of time. They can easily go they go to the 79th

street, 87th street or 95th street Red Line stations during rush hour and it

could easily get a few (or rather several) opinions the perspectives on the candidates.

While I understand that in broadcast journalism it may not be feasible

to even name all 17 candidates in one story, there is absolutely NO excuse to

not refer people to a website that could have a listing of all of the

candidates with some basic information on them for a journalist it would take

less than a day to research, if not call AND talk with all of those candidates.

It should be no problem at all just to find out basic contact information such

as phone numbers, email addresses, and websites as well as a short biography

(including where they now live, so one could get a sense of what communities

they might best represent).

Journalists also have access to a number of high quality

journalism schools such as Northwestern University’s Medill School of Journalism

(which I am a graduate of ) as well as Columbia and others. It would be easy

for them to recruit to recruit members from classes. Students would be able to

do some of that basic research. One class alone could get the basic information

I am especially disappointed with our nonprofit media,

of which we have several distinctive organizations such as Chicago public media,

WTTW, Axios, and Pro Propublica, all of which even if they had to share duties,

could easily create forums for the public to be able to more adequately

research their choices

Also, in this day and age, one could easily take a

test online test to see which Harry Potter house 1 could fit would be would fit

in with and those things would actually be and that quiz would actually be

accurate why could we not set up a quiz that not only speaks on the issues that

are most important to constituents but also other items such as communication

style leadership abilities or leadership experience that would help voters

decide who would best represent them in Congress right now. The question is:

will the 1st congressional district have someone like AOC who is able to make a

national headlines despite being a freshman or with the representative be

someone who would be forgotten amongst the other 434 representatives in the

house today

I would love to hear from community residents of the 1st

congressional district to hear what do they think about this issue of coverage.

Do they feel that they are actually being represented in the news, or should

things be changed or improved in some way. I also would love to hear from those

in the media to see what are they going to do differently to help the residents

of the 1st congressional district make a good choice as to who they would want

to represent them answer represent them I hope

I would also love to hear from media in the Chicagoland

area to see what they are going to do different in the next few weeks before

the election so that residents of the area would actually have a choice a fair

choice as to who they should pick, and that it's not based on popularity that

is predetermined by the media or by other media or by campaign funds

In a future post (probably October) I will also follow up to

see how many Democratic candidates who DID win their primary election have

decided to drop out which would allow Democratic Party to install somebody else

so which would in effect create voter OMISSION, which is even worse than voters

suppression because they would not have a choice at all in the matter that

99.99% of residents would not have a choice in their candidate

Please, Chicago media, DO BETTER. And for all Chicago

residents who say they are concerned about voter rights – demand better from

those who say they are here to inform us. Don’t we deserve it?

The following list is on the official Illinois election

website.

https://www.elections.il.gov/ElectionOperations/CandidateList.aspx?ElectionID=63aIZoIunYs%3d&OfficeID=LMmcDTEwiCK%2fpmC%2ftG8m2A%3d%3d&Status=P2wRQXkiFoo%3d&BallotGroup=FTIb1gd6z9Y%3d&QueryType=xF443FTCAJbIL3atac%2fUjEg7Y4yklgT1&T=637897870742235127

You can also try

https://www.elections.il.gov/ElectionOperations/CandidateFilingSearch.aspx?ID=63aIZoIunYs%3d&T=637897870545532522

or look up candidate filings search at www.elections.il.gov

|

Name

|

Write-In

|

Objection Pending

|

Office

|

Party

|

File Date

|

Status

|

|

BIRGANS, KIRBY

7524 S. EVANS AVENUE

UNIT 1

CHICAGO, IL 60619

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/14/2022

8:04 AM

|

Active

3/14/2022

|

|

BUTLER, CHRIS

1822 WEST 105TH STREET

CHICAGO, IL 60643

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/7/2022

8:00 AM

|

Active

3/7/2022

|

|

CARLSON, ERIC

4 WILD PLUM CT.

LEMONT, IL 60439

|

|

|

1ST CONGRESS

|

REPUBLICAN

|

3/10/2022

12:29 PM

|

Active

3/10/2022

|

|

COLE, JAHMAL

8035 S. WABASH AVE.

CHICAGO, IL 60619

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/7/2022

8:00 AM

|

Active

3/7/2022

|

|

COLLINS, JACQUELINE "JACQUI"

7600 S. LOOMIS BLVD.

CHICAGO, IL 60620

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/7/2022

8:00 AM

|

Active

3/7/2022

|

|

DeJOIE, STEVEN

8440 SOUTH KING DRIVE

CHICAGO, IL 60619

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/14/2022

9:21 AM

|

Active

3/14/2022

|

|

DOWELL, PAT

4414 S. MARTIN LUTHER KING, JR. DR.

CHICAGO, IL 60653

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/7/2022

8:00 AM

|

Active

3/7/2022

|

|

GOODRUM, CASSANDRA

7300 S. CONSTANCE AVE.

CHICAGO, IL 60649

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/7/2022

8:00 AM

|

Active

3/7/2022

|

|

JACKSON, JONATHAN L.

6828 SOUTH CONSTANCE

CHICAGO, IL 60649

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/7/2022

8:00 AM

|

Active

3/7/2022

|

|

LEWIS, MARCUS

3146 HOLDEN CIRCLE

MATTESON, IL 60443

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/7/2022

8:00 AM

|

Active

3/7/2022

|

|

MATTHEWS, AMEENA

16719 ANNE MARIE AVENUE

TINLEY PARK, IL 60477

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/14/2022

5:00 PM

|

Active

3/14/2022

|

|

McGRIFF, NYKEA PIPPION

6139 S. DREXEL AVENUE

CHICAGO, IL 60637

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/14/2022

5:00 PM

|

Active

3/14/2022

|

|

NIX, DARIUS "DEE"

7145 S. CALIFORNIA AV.

CHICAGO, IL 60629

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/9/2022

12:43 PM

|

Removed

4/21/2022

|

|

NORINGTON-REAVES, KARIN

8232 S. WABASH AVE.

CHICAGO, IL 60619

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/7/2022

8:00 AM

|

Active

3/7/2022

|

|

O'KEEFE, MATTHEW "MATTO"

9930 S. WINCHESTER AVE

CHICAGO, IL 60643

|

|

|

1ST CONGRESS

|

REPUBLICAN

|

3/14/2022

2:34 PM

|

Withdrawn

4/7/2022

|

|

PALMER, ROBERT A.

7315 S. UNIVERSITY AVE.

CHICAGO, IL 60619

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/11/2022

3:51 PM

|

Active

3/11/2022

|

|

REGNIER, JEFFERY T

24104 S. OLD FARM ROAD

MANHATTAN, IL 60442

|

|

|

1ST CONGRESS

|

REPUBLICAN

|

3/14/2022

5:00 PM

|

Active

3/14/2022

|

|

ROSNER, TERRE LAYNG

7442 W. LAKESIDE DRIVE

FRANKFORT, IL 60423

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/10/2022

2:45 PM

|

Active

3/10/2022

|

|

SPAULDING, STEPHANY ROSE

10929 S STATE STREET, UNIT 1

CHICAGO, IL 60628

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/10/2022

11:27 AM

|

Removed

4/21/2022

|

|

SPILLER, HOWARD L.

9840 S. PULASKI RD

OAK LAWN, IL 60453

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/14/2022

2:06 PM

|

Removed

4/21/2022

|

|

SWAIN, JONATHAN T.

1130 E. HYDE PARK BOULEVARD,

APARTMENT 1

CHICAGO, IL 60615

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/14/2022

5:00 PM

|

Active

3/14/2022

|

|

THOMPSON JR., MICHAEL A.

4238 SOUTH WABASH AVENUE UNIT 1

CHICAGO, IL 60653

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/7/2022

8:00 AM

|

Active

3/7/2022

|

|

WHITE, PHILANISE

8447 S. PHILLIPS STREET

CHICAGO, IL 60617

|

|

|

1ST CONGRESS

|

REPUBLICAN

|

3/14/2022

8:04 AM

|

Active

3/14/2022

|

|

WILLIAMS, CHARISE A.

1726 EAST 87TH PLACE

CHICAGO, IL 60617

|

|

|

1ST CONGRESS

|

DEMOCRATIC

|

3/14/2022

5:00 PM

|

Active

3/14/2022

|

|

YOUNG, GENO

8858 S. KENWOOD, AVE.

CHICAGO, IL 60619

|

|

|

1ST CONGRESS

|

REPUBLICAN

|

3/14/2022

5:00 PM

|

Active

3/14/2

|